Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

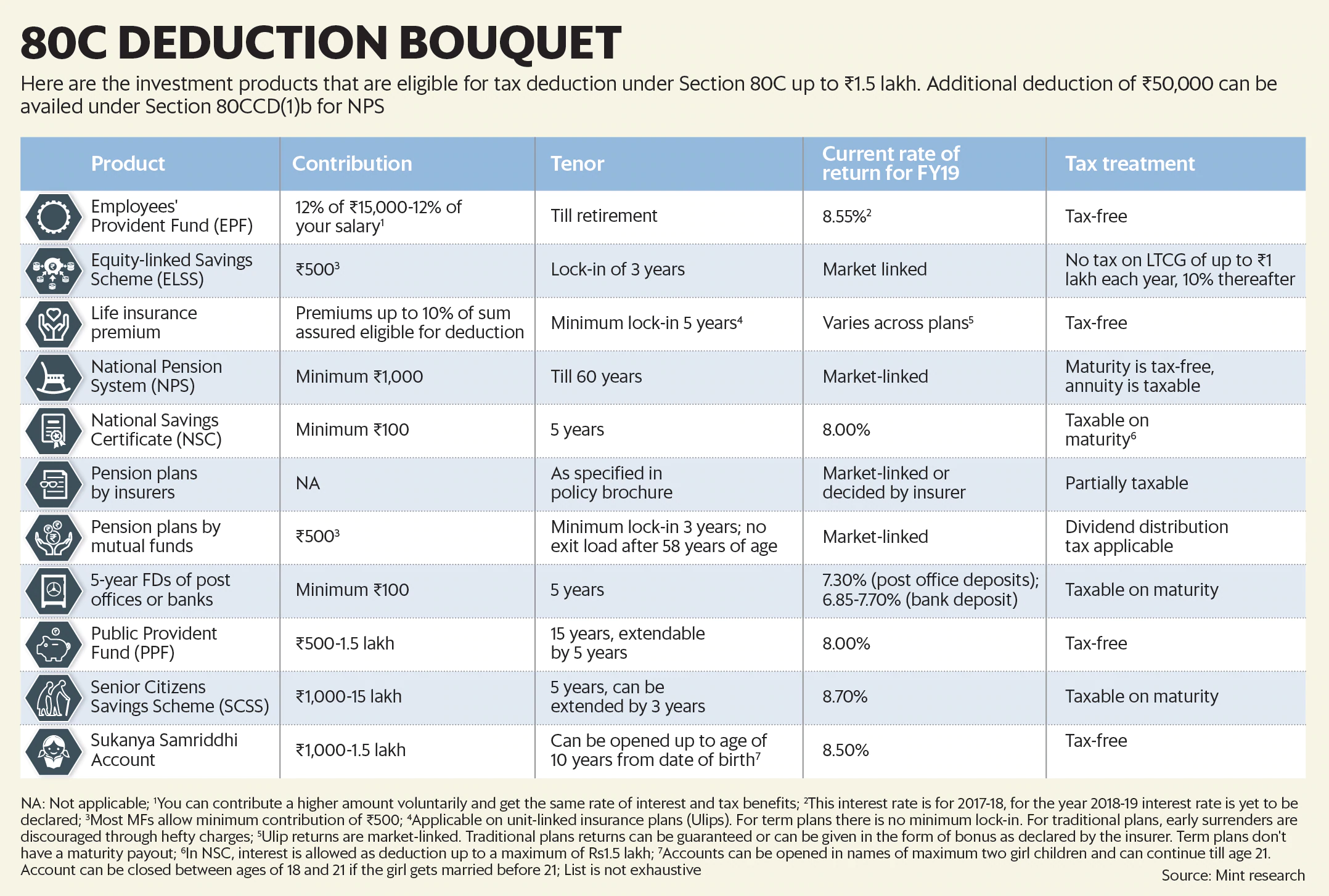

They say change is the only constant in life. That’s true even when it comes to your finances—your earnings, expenses and savings change over time, and so do your financial goals. That is why your strategy to invest in order to save taxes need to be reviewed and changed as you reach different stages of life. For instance, a single person or a young married couple or even a retired person may not have to pay tuition fees, which comes under the Section 80C deduction basket, and, therefore, would need to save extra to exhaust the ₹1.5 lakh limit. On the other hand, a person who contributes to the Employees’ Provident Fund and has a high home loan principal annual payment may exhaust the 80C limit without having to save or invest in any other product.

Then there are other factors to consider such as your financial goals and the risk profile. Most financial planners believe that tax planning is an integral part of financial planning. “Whichever stage of life one is in, tax saving investments should take care of immediate short-term tax-saving as well as long-term strategic goals. Tax-saving investments should align with one’s overall asset allocation of debt and equity and factor in lock-in period and post-tax return," said Varun Girilal, co-founder and executive director, Mitraz Investment Advisors. Your asset allocation, in turn, depends on factors such as risk appetite, goals and life stage.

Here’s how you can plan your tax-saving investments at different stages of your life.

Most people start their career in their 20s; at this stage their risk appetite is typically higher as there is enough time to build a robust portfolio to achieve future goals. “For someone who is in the age band of 25-35 years, ideally 65-70% should be allocated to equity-related instruments," said Rahul Jain, head, personal wealth advisory, Edelweiss.

While there are a few pure equity tax-saving options such as equity-linked savings schemes (ELSS), some like National Pension System (NPS) allow investment in equities as well as debt. “Investors in the early stages of their career may choose ELSS, which qualify for tax deduction of up to ₹1.5 lakh. One should invest in them with an investment horizon of at least seven years," said Kusal Roy, managing director, Tata Capital Financial Services.

However, even at this stage, you should have some debt investments as well. For that, “a portion can be allocated to PPF and NPS, to help build a steady retirement corpus," added Roy.

You should also have adequate life insurance if you have dependants. A health insurance policy with a basic cover of at least ₹5 lakh is a must-have. Both offer tax deduction under different sections of the Income Tax Act.

At this stage, you would already be shouldering a lot of responsibility and have a better vision of your financial goals. You should start by reviewing your insurance needs. You would need to protect your family against loss of your income as well as liabilities like a home loan. “It is important to increase life and health insurance covers if there is a need to do so," said Jain.

The next step is to look at asset allocation. As you enter mid-life you can marginally increase your debt allocation. “Allocation of funds towards debt should gradually increase which means higher distribution to PPF and lower allocation to ELSS," said Jain.

Also, look at your EPF contribution and expenses such as children’s tuition fees and home loan principal repayment. It’s possible that these are large enough to exhaust your 80C limit. “In this age group, there is a high likelihood of having a home loan and savings under Section 80C may get covered by the principal repayment. In case the principal repayment is lower in the first few years, one can always make extra repayment towards principal instead of looking at tax-saving options," said Girilal.

After you retire, the pension you receive from your employer or any other income that you earn is also taxable. Therefore, you may need to keep investing to save tax even after retirement.

But the focus will now shift to fixed-income and debt category products as risk appetite is low. “As one approaches retirement or post retirement, the appetite for risk is much less, here one can opt for tax-saving fixed deposits from banks," said Roy.

Also, at this stage, you can’t opt for an instrument with a long maturity period, as liquidity would be a concern. “At this stage, regular income becomes the most important decision factor. The choice of investments can change from PPF to a relatively shorter tenure instruments like bank fixed deposits and Senior Citizen Savings Scheme which offers quarterly interest payout. While one may not need life insurance post-retirement, health insurance should continue," said Jain.

However, some experts believe that even when you are close to retirement or post retirement you can consider investing some portion of your savings in equity instruments. “At every stage of life, there an equity component is recommended," said Girilal. His firm recommends 15-30% equity investment even for the retired, based on clients’ willingness to deal with volatility. “In such cases, even senior citizens can consider ELSS," said Girilal.

Your criteria to choose an investment product to save taxes should be based on its merits and how it fits into your portfolio. Tax savings should be incidental and not the primary criteria.

Copyright © 2025 Design and developed by Fintso. All Rights Reserved