Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

This is because the banking regulator merges a troubled bank with a sound one and depositors will have to wait for the process to be completed before they can get their money or stop worrying about its safety . The RBI orders a moratorium when a bank’s financial stability is threatened. Depositors face some restrictions on withdrawing money from their accounts during this period. Currently , the restriction is confined to premature withdrawal of FDs in case of Kapol Bank. Customers can still withdraw money from their savings and current accounts. However, the Banking Regulation Act has provisions for relief to customers facing a financial emergency .

The Reserve Bank of India’s (RBI’s) decision to impose restrictions on premature fixed deposit (FD) withdrawals from Kapol Bank, a multi-state scheduled bank, last week has left many depositors in a fix. Reports of retired individuals facing a cash crunch have already surfaced in the media. Luckily, the customers of the bank don’t have to worry about the safety of their money, as they will get it back after maturity of deposits. However, customers of many other troubled co-operative banks are often not as lucky as they have to wait longer to get their money back.

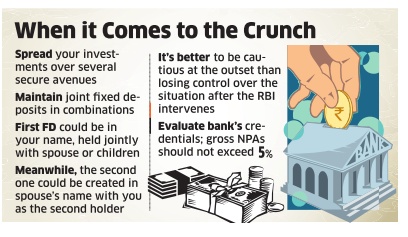

“Banks’ administrative board can approach the RBI with a plea for relaxing the withdrawal limits in case of accountholders such as those who have saved or deposited money for their medical treatment or educational purpose and pensioners,“ says VN Kulkarni, chief credit counsellor with the Bank of India-backed Abhay Credit Counselling Centre. Spread Your Risks Since one cannot do much after the bank gets into trouble or the RBI comes into the picture, it would be wise to take some precautions. “Depositors need to be selective not only in choosing the bank, but also in depositing the amount using different combinations,“ says Kulkarni.

For instance, you can maintain the first deposit in your name, held jointly with your spouse or children. Similarly, the second joint FD could be created with your wife as the first holder. This will help you benefit from the deposit insurance cover extended to retail depositors. Currently , deposits are insured up to `. 1 lakh per bank, and not per branch of the same bank. You can also look at maintaining FDs in more than one bank to spread out the risk. However, this may not be feasible for some individuals. For instance, a retiree who wishes to invest her huge retirement corpus in FDs . “It is not feasible to split a huge amount of, say, `. 50 lakh into 50 deposits with different banks.

Senior citizens have to strike a balance between convenience, risks and higher returns that some of the smaller banks offer,“ says Suresh Sadagopan, certified financial planner and founder, Ladder7 Financial Advisories. He recommends diversification by investing in fixed income options like company FDs, nonconvertible debentures (NCDs) as also more secure alternatives such as tax-free bonds and senior citizens savings scheme, which offers an interest rate of 9.2% . You must also evaluate the bank’s credentials carefully before parking your money in it.

“While selecting the bank, you need to ascertain its gross NPAs. It should be not higher than 5%. Similarly, ensure that your bank has adequate capital as prescribed by the regulators,“ says Kulkarni. “That is, minimum 9% of riskweighted assets, and at least 12%, in case of co-operative banks.“

Copyright © 2025 Design and developed by Fintso. All Rights Reserved