Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

“Due to a limited balance on these preloaded cards, the damage due to any fraud is restricted to that amount,“ says Harshvardhan Roongta, certified financial planner, Roongta Securities. Recently , the Reserve Bank of India (RBI) had reiterated that banks were allowed to issue rupee-denominated co-branded prepaid cards, without seeking permission from the central bank, unlike non-banking financial companies . In addition, last year, the regulator had allowed cash withdrawal of up to ` . 1,000 per day from prepaid cards, including gift cards, from point of sale (POS) terminals. International Travel Cards Travel cards have gained popularity in the last few years, with most public and private banks offering them. They are targeted at students, tourists and business travellers.

Consider this scenario: After carrying out online research, you have zeroed in on a suitable hotel at the tourist spot you wish to visit, but it is not a well-known one. Yet, it insists on an advance payment through your credit or debit card -details of which you are unwilling to share due to concerns over the site’s reliability . At the same time, you are reluctant to let go of a money-saver deal. What is the way out of this dilemma? You should try the `virtual’ card tool, if your bank offers the facility. On the other hand, if your travel destination happens to be located abroad, you can simply make use of forex travel cards.

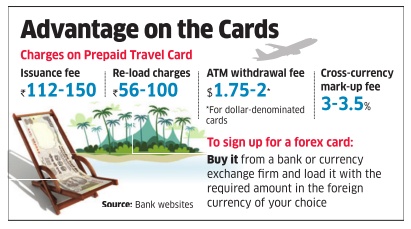

“They can come to your aid while making payments online or at parking lots in your destination countries. Convenience is the key benefit,“ says Roongta. To sign up for a forex card, you can walk into a bank or a currency exchange firm to buy it and load the card with the required amount with the foreign currency of your choice. The issuance fee ranges from ` . 150. Other . 110 to ` charges include cash withdrawal fee at ATMs ($1.75-2) and cross-currency charges. “However, they score over debit and credit cards by eliminating currency fluctuations, as the exchange rate applicable on the day of transaction gets locked in the day you load the card,“ says VN Kulkarni, chief credit counsellor with the Bank of India-backed Abhay Credit Counselling Centre. However, do remember that you need to be vigilant while transacting online with these cards.

“The additional layer of protection -the two-factor authentication -that secures transactions in India is not available in many other countries,“ says Roongta. Also, note that these cards cannot be used to transact within India. Virtual Cards E-wallets or virtual cards are meant only for online payments. Banks like SBI, Axis Bank, Kotak Mahindra and HDFC Bank offer such facilities free of charge currently . The mechanism allows you to generate a virtual card that functions like a credit or debit card for online payments. To create a virtual card, you need to transfer the required funds from your account into this `card’, set a limit, and a password.

“These cards can be a one-time use card or multiuse cards. Generally , these cards cannot be reloaded, but some banks do offer a reloading facility . Further, these cards have shorter expiry dates as compared to regular debit cards, and post the expiry , unutilised money gets credited to the originated bank account,“ says Deepak Sharma, executive vice-president, Kotak Mahindra Bank. Once the card is created, the process of online payments will be similar to credit and debit cards. The amount loaded is lower, and risks are limited.

Copyright © 2025 Design and developed by Fintso. All Rights Reserved